da imran mateen mancano 12 anni

247

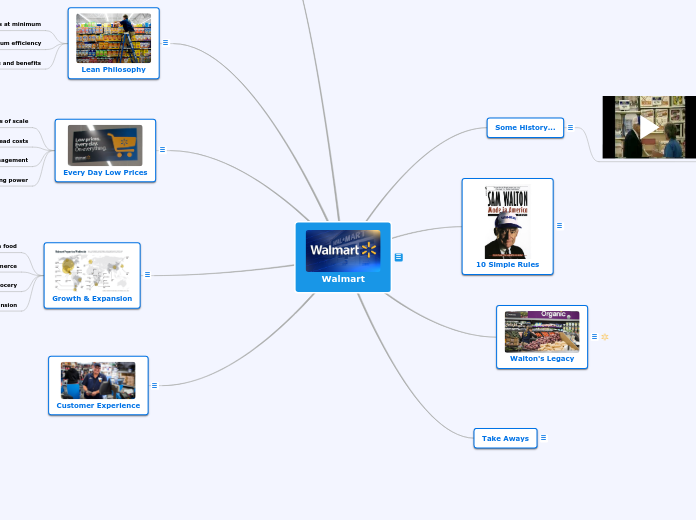

al abid basis to develop buyout-rehab-exit strategy

The proposed strategy involves developing a buyout-rehab-exit plan, aiming to fully package and sell the business to new investors, which could include international or local entities.